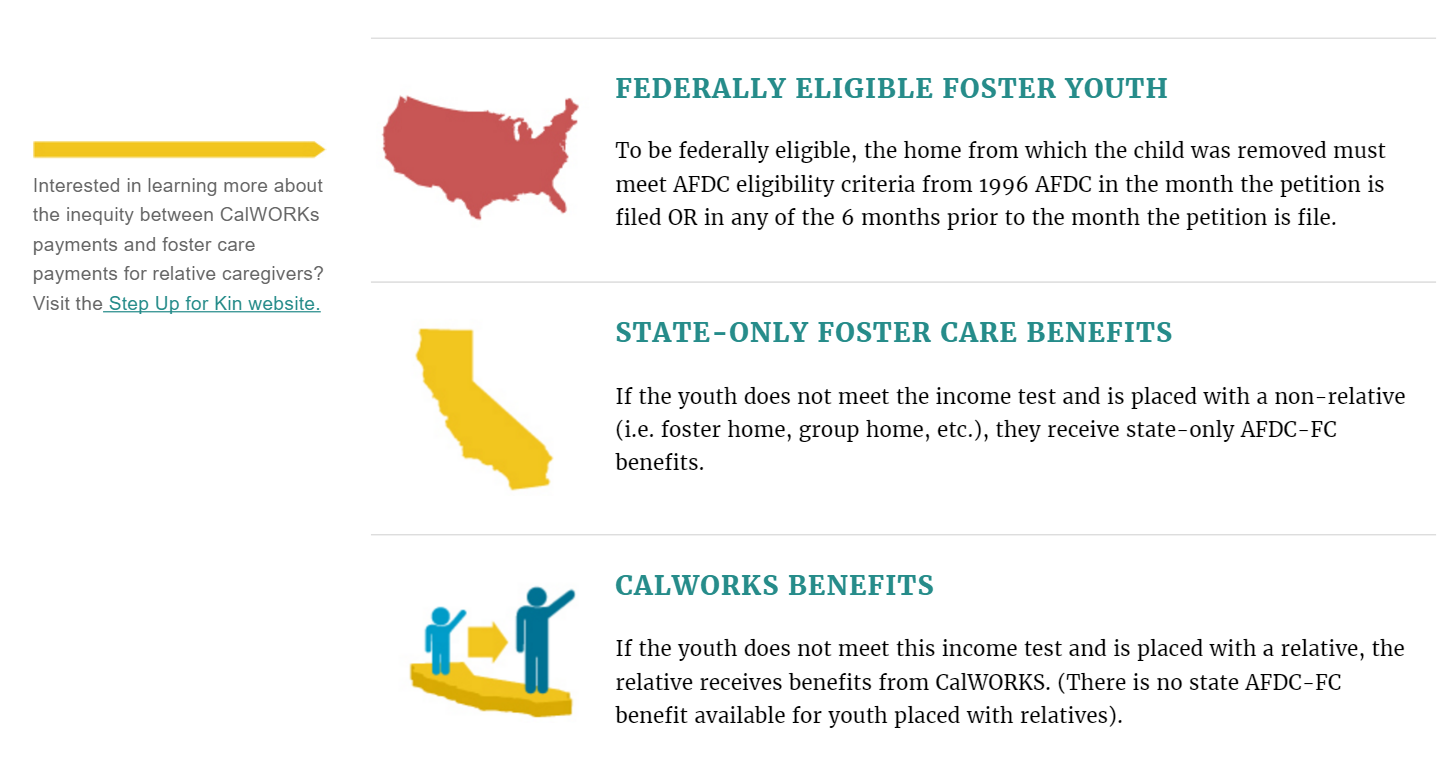

If a child removed from their home and placed in foster care is eligible for federally funded foster care, they receive a combination of federal and state foster care benefits. If the child is not eligible for federally funded foster care, they either receive state-funded foster care benefits, or CalWORKs benefits, depending upon whether or not they are placed with a relative caregiver.

In the latter situation, relative caregivers receive fewer benefits than non-relative caregivers. However, new legislation has been passed allowing counties to fix this inequity. To find out how you can encourage your county to resolve this disparity, visit Step Up for Kin’s legislation page.

Determination about foster care eligibility will have been made prior to the youth entering extended foster care.

In the latter situation, relative caregivers receive fewer benefits than non-relative caregivers. However, new legislation has been passed allowing counties to fix this inequity. To find out how you can encourage your county to resolve this disparity, visit Step Up for Kin’s legislation page.

Determination about foster care eligibility will have been made prior to the youth entering extended foster care.

How Does This Impact Non-Minor Dependents?

Once a non-minor, if the youth chooses to live in a SILP with a relative, the youth would be eligible for a state-only AFDC-FC payment (because the SILP is not technically a placement with the relative). This is important because a state-only AFDC-FC benefit may provide a larger benefit to the youth. It’s important to think about transferring into a SILP for these youth rather than continuing to have them placed with the relative where they will receive CalWORKs.

When non-minor dependent youth re-enter foster care, a new qualification for foster care benefits is needed, but is based solely on the youth’s income and property.

Once a non-minor, if the youth chooses to live in a SILP with a relative, the youth would be eligible for a state-only AFDC-FC payment (because the SILP is not technically a placement with the relative). This is important because a state-only AFDC-FC benefit may provide a larger benefit to the youth. It’s important to think about transferring into a SILP for these youth rather than continuing to have them placed with the relative where they will receive CalWORKs.

When non-minor dependent youth re-enter foster care, a new qualification for foster care benefits is needed, but is based solely on the youth’s income and property.

Youth receiving CalWORKs benefits receive a smaller monthly amount than youth receiving AFDC-FC benefits (e.g. For a 15 year-old, the foster care rate paid is $820 per month, and the CalWORKs payment is $351). CalWORKs youth are not eligible for a clothing allowance, transportation assistance, an infant supplement (for parenting youth), or a Specialized Care Increment (for youth with special needs).